The topic of takeout in horse racing as is one that is highly contentious in the industry for the horse racing customer. The customer’s understanding of this concept varies as much as the condition books for tracks across the country. The casual fan may not even be aware of what takeout is while the more seasoned player uses it as a map of where they choose to play. Simply put, takeout is the fee the racetrack and horse owners charge to put on the racing performance. Las Vegas Sports Books and bookies have a similar fee. They call it “the juice”.

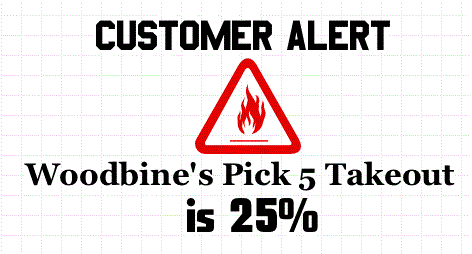

In horse racing the “juice” is generally 20%. This fee is a percentage of the handle wagered on the race card for the day. In other words, if $100,000 is placed to “win” on a race, the house (ie racetrack, and horse owners) removes $20,000 with $80,000 split by all the gamblers with the winning ticket. The actual percentage of each bet varies by racing jurisdiction. A great website for horse players is Horseplayers Association of North America. You can find the takeout rates in each jurisdiction there.

Takeout has been debated over the years (especially in handle declining years) due to the importance it serves for both sides of the wagering counter. One argument for a lower takeout is that it means more money in winnings is returned to the customer and that could result in more “churn” back into the wagering pools. Studies have determined the more you return to the gambler, the more is gambled back. Nowadays this theory seems to be in trouble because in the age of simulcast, a player can wager on any race, in any state and several internationally. If Race track A charges a 15% takeout and you win your wager, getting back more money, kudos to you. However, if you then take your winnings and wager on Race track B with a 20% takeout, you effectively have churned your winnings into a different pool essentially providing Race track B with the “benefit” of the lower takeout. Using this example, you can see why racetracks are reluctant to change their takeout levels.

The magical unicorn that has evaded the industry for so long now is the optimal price point. This price point is one that drives wagering handle so that the wagering dollar is maximized for all the parties involved. If takeout was set at 0%, handle would soar, but the racetracks, horse owners and the state would receive nothing. This would not be economically feasible. At 50%, the takeout is so high that few would wager because of the high take. The availability of many other gaming alternatives gives the player options elsewhere.

As an owner within our horse racing partnerships, and an occasional horse player, I can tell you the racing industry does not operate in a vacuum anymore. The years of it being the only legal form of gambling have long passed. With the advent of the state lottery, casinos popping up as fast as gaming licenses can be obtained, and the booming growth of fantasy sports, the racing industry has to evolve if it hopes to survive. Consumers of any industry speak with their wallets. Experimental ideas like Canterbury Downs are great ones in our opinion. Finding the optimal takeout is crucial to the growth of our sport and continued sucess for owners in horse racing partnerships.